Affiliate Disclosure: Automoblog and its partners may earn a commission if you get an auto loan through the lenders outlined below. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of auto lenders. See our Privacy Policy to learn more.

By: Kate Butler and Jacob Huther

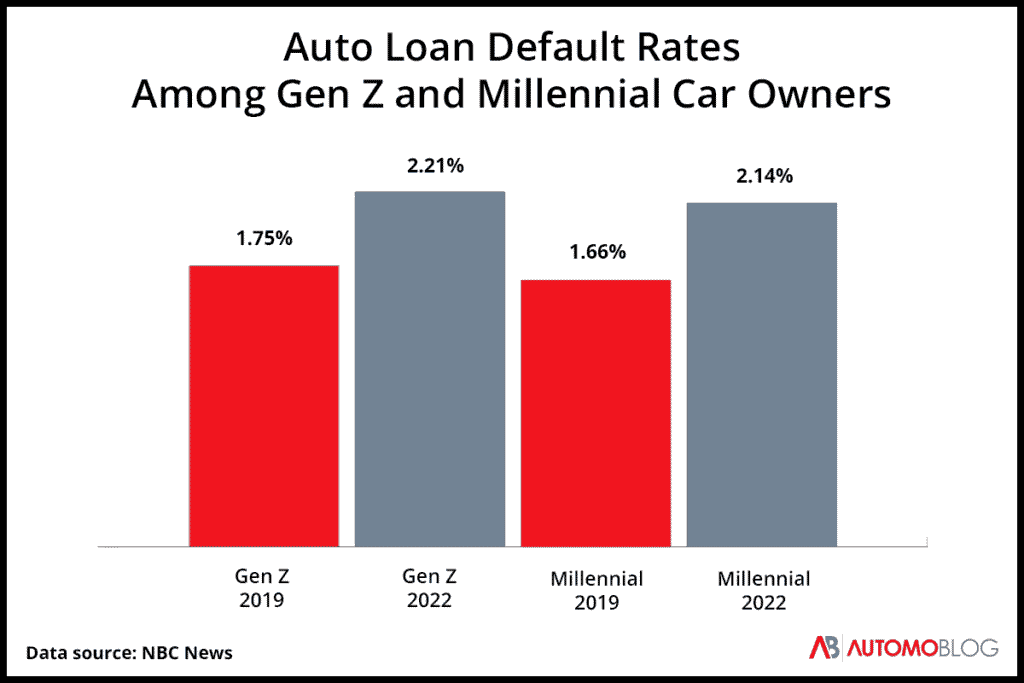

Defaulting on a loan can affect your life for years to come. Now more than ever, young adults are defaulting on auto loans at an alarming rate. According to a recent NBC News article, TransUnion data comparing prepandemic and current default rates for Generation Z (Gen Z) and millennial car owners shows startling differences.

In 2019, before the pandemic began, Gen Z had a past-due rate of 1.75%. Today, past-due rates have reached as high as 2.21% among Gen Z car owners. Similarly, millennials now show increased past-due rates of 2.14%, compared with 1.66% before the pandemic.

Preventing loan default in the current financial landscape can be challenging – especially for individuals early in their careers and learning to balance new expenses with financial freedom. To help you navigate these potential financial challenges, we cover the consequences of defaulting on a car loan and the best methods to prevent loan default.

What Does It Mean To Default on an Auto Loan?

Defaulting on an auto loan means you have missed a payment or stopped paying back what you owe on your car. To pay off a loan from a lender or dealership, you have to make monthly payments for the term length you agreed to in your loan contract. When you’ve completed all the payments, you gain ownership of the vehicle.

Though it varies by lender, your vehicle loan is likely to default after only one missed payment. Typically, your loan agreement will detail how many days you can miss before your loan defaults. After you are late on a payment to the point of defaulting, lenders generally have 90 days before they can legally repossess your vehicle.

What Happens When You Default on a Loan?

Especially in today’s financial environment, there are many reasons someone may default on their auto loan. However, the consequences of defaulting on your loan can be severe and affect your financial future.

If you’re a millennial or Gen Z car owner struggling to make your car payments, it’s important to understand what can happen if you find yourself in this situation. Be sure to go through your loan agreement in detail with your lender so you know what to expect if you miss a payment.

Your Credit Score Will Be Negatively Affected

Late repayments on car loans will more than likely lower your credit score, depending on how late the payment is and the terms of your loan agreement. A loan default will also add a negative mark to your credit report, in addition to the late repayment.

Your Car May Be Repossessed and Sold

Once your loan defaults, the lender is legally allowed to repossess your vehicle. You will be notified by your lender beforehand with a final opportunity to cover the missed payments before repossession. If you are unable to cover the missed loan amount, your lender will likely take back your vehicle and sell it.

You Could Still Owe Money After Repossession

If your lender is able to sell your vehicle at a fair market price, you likely won’t have to cover the remainder of your loan amount. However, if the lender sells your repossessed vehicle for less than your loan default balance, you’ll still have to pay the difference. This is called a deficiency balance, which ensures the lender doesn’t lose money from your missed loan payments. You are also responsible for any costs associated with repossessing your vehicle.

Your Remaining Debt Could Be Sent to Collections

If you don’t cover the deficiency balance, your debt could be sent to a third-party collection agency. Then, if you don’t pay the balance in an appropriate time frame, the agency will likely sue you for repayment.

How Today’s Financial Environment Affects Younger Borrowers

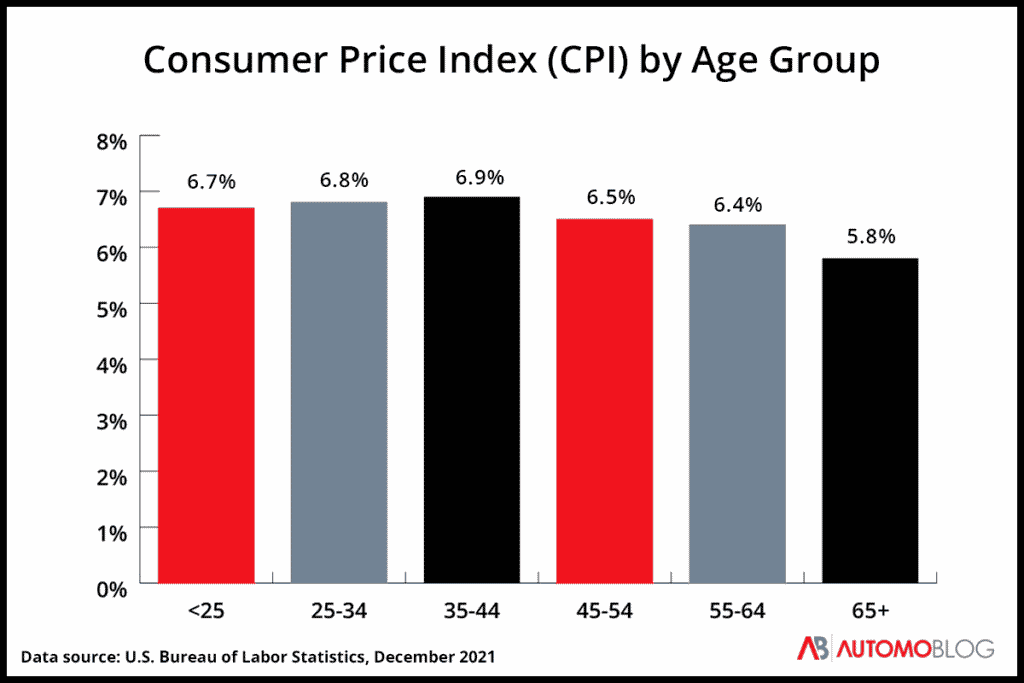

In today’s financial environment – which has been impacted by a worldwide pandemic, inflation, geopolitical conflict, and more – it is increasingly difficult for many people to keep up with financial obligations. Inflation has especially affected Gen Z and millennials. According to a study by Wells Fargo, younger generations experienced some of the highest rates of inflation in 2021 compared to older generations.

On top of inflation, average vehicle costs have gone up. According to Cox Automotive, the average cost of a new car reached $47,148 as of May 2022. This is a 13.5% increase from the average cost only one year ago, in May 2021. Record-breaking new vehicle prices are making car purchases an even bigger challenge, now requiring 40.6 weeks of income on average – close to one year’s worth of pay.

These financial challenges may contribute to the increased auto loan default rates of Gen Z and millennial car owners in particular. According to TransUnion data, 4.35% of car owners ages 18 to 40 were at least 60 days late on their auto loans in early 2022. As mentioned above, the data also shows that current default rates for Gen Z borrowers are 0.46% higher than they were pre-pandemic, while rates for millennial borrowers show an even larger increase, of 0.48%.

Why Are Gen Z and Millennials Defaulting on Auto Loans?

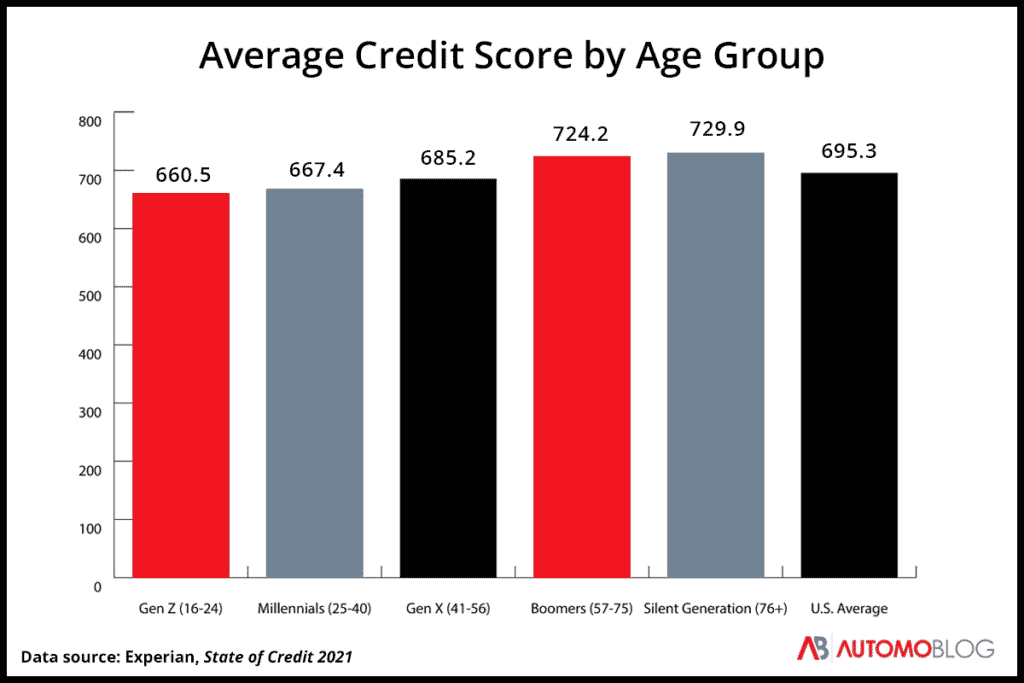

In addition to Gen Z and millennials experiencing higher rates of inflation, they are dealing with negative financial effects due to lower average credit scores. The average U.S. credit score required to purchase a new car was 726 in 2021. Gen Z has an average credit score of 660.5, while the average score for millennials falls at 667.4.

With lower-than-average credit scores, it can be much more challenging to purchase a new car – or get an auto loan. With the average credit score needed to secure an auto loan sitting at 726 for new cars and 675 for used cars, there are many among Gen Z and millennials who will likely have difficulty getting a loan. Additionally, lower credit scores result in higher auto loan interest rates, ultimately making it more challenging for Gen Z and millennial car owners with lower credit scores to pay off what they owe.

Another challenge that likely contributes to higher default rates is the increasing amount of time it takes to pay off an auto loan. In 2021, 27.21% of auto loan borrowers were taking 73 to 84 months to pay off their loan, an almost 7% rise from the previous year. With a longer loan term, borrowers will likely pay a higher interest rate and ultimately end up paying more over time. Stacked with higher interest rates from having lower credit scores on average, this can increase the likelihood of loan default for Gen Z and millennials.

The increasing auto loan default rates for Gen Z and millennials highlight just one of the financial challenges facing the younger generations today. If you’re a young car owner, learning how to avoid defaulting on your auto loan can help you avoid financial implications that can affect not only your credit score, but also your financial stability.

How Can You Prevent Auto Loan Default?

Taking action to prevent auto loan default can save your financial future and credit score. If you’re faced with car loan payments you’re unable to make or are at risk of defaulting on your auto loan, there are steps you can take to help prevent this.

Refinance Your Car Loan

Refinancing your car loan is a smart option if you haven’t yet defaulted on your loan but think there’s a possibility you might. If you are approved to refinance, a new lender will pay off your existing loan and take over the car title from your current lender. Ideally, you’ll want to find a refinance loan with a lower interest rate, lower monthly payments, or both to make the loan payments more manageable.

Refinancing an auto loan isn’t an option for everyone. If you owe more money than what your vehicle is worth or your credit score has dropped since you got the original loan, you may not be approved for refinancing.

Negotiate With Your Lender

If you’re concerned that you won’t be able to cover your next monthly loan payment, contact your lender immediately. Proactively reaching out to discuss your loan situation may make your lender more willing to negotiate a different payment timeline or loan option.

Voluntarily Surrender Your Vehicle

If you missed a loan payment and feel you are unable to make up for lost time, you can willingly surrender your vehicle, known as voluntary repossession. Although you will still get a negative mark on your credit history for failing to pay back your loan, the effects are not as bad as repossession.

Have Someone Else Take Over the Loan

In special cases, you may be able to transfer the loan to another individual. This is not accepted by many auto loan lenders, though some may approve it if the party has a strong credit score and is able to cover the costs you originally agreed to with your lender. Make sure to contact your lender to see if this is a possibility before making decisions with a third party.

Consolidate Debt

This can be a good option if you’re struggling to pay off other debts like credit card debt or student loans. Getting a personal loan is one way to consolidate debt and help pay off your car loan. You must have a high credit score and a reliable plan to keep your debt under control for this to be an effective strategy.

Gen Z and Millennials May Continue To Face Auto Loan Default

Auto loan default rates may continue to rise for Gen Z and millennials, threatening severe consequences and endangering the future financial stability of these borrowers. With young car owners at risk of declining credit scores and increasing debt, learning how to prevent auto loan default can help you avoid these repercussions.

Managing any new financial freedom requires responsibility. To help combat the loan debt crisis Gen Z and millennials are facing, you should communicate with your lender before getting an auto loan, build your credit, and discuss options with your bank if you’re experiencing financial stress. Taking the proper financial precautions before getting an auto loan can protect against the possible long-term consequences of defaulting.