As electric vehicles (EVs) take up more and more of the overall automotive market share, the need for a robust and reliable EV charging network continues to grow. But since the widespread adoption of EVs is a relatively recent phenomenon, the U.S. has yet to adopt a universal standard for the type of connectors used to charge the vehicles.

That appeared to be changing as more automakers moved towards the Combined Charging System (CCS) in recent years. However, auto giants Ford and General Motors recently announced that they would be designing their EVs to use the North American Charging Standard (NACS) system created by Tesla. This announcement launched an EV charging standard war that could have major implications for the EV industry.

There Are Two Dominant Types of EV Charging Connections

The technology and design of EV chargers have evolved since the vehicles first entered the mainstream. One of the earliest plug designs to be broadly adopted was the J1772, first produced in 2009. The J1772 plugs have been commonly called “chargers,” but are more accurately described as EV power supplies since they do not charge an EV battery directly. Because they only conduct AC power, they supply power to the vehicle’s onboard charger, which then converts that power to DC to charge the battery itself.

While other designs have come and gone, at present there are two types of charger connections that account for the majority of EV chargers in use.

The Combined Charging System Had Emerged as the Standard

The CCS charging system was built off of the J1772 plug: it took the original plug design and added a DC plug. This enhanced design allows the charger to bypass the power supply and use DC electricity to charge the battery directly. The result is a much faster charge that also eliminates the need for two charging ports, cables, and plugs.

Until recently, it appeared as if CCS had “won” the earlier iteration of the charging standard war. In February, the Biden administration announced a series of regulations and incentives designed to bolster the EV industry called the Bipartisan Infrastructure Law (BIL). Among the facets of the law is a $7.5 billion fund earmarked for EV charging development.

The administration outlined several requirements for companies to access those funds. Like with programs in the Inflation Reduction Act, eligibility hinges on at least 55% of EV charger components being produced domestically by June 2024. But the regulations also stipulate that charging stations must incorporate CCS technology. This portion of the BIL appeared to cement CCS as the de facto EV charging standard for the U.S.

Tesla Has Continued To Push Its Own Charger Design

As CCS appeared to be on its way to becoming the dominant charger design, Tesla continued to develop its own charging technology. First referred to as the Tesla Supercharger, the company renamed the system to the North American Charging Standard (NACS) in November, 2022.

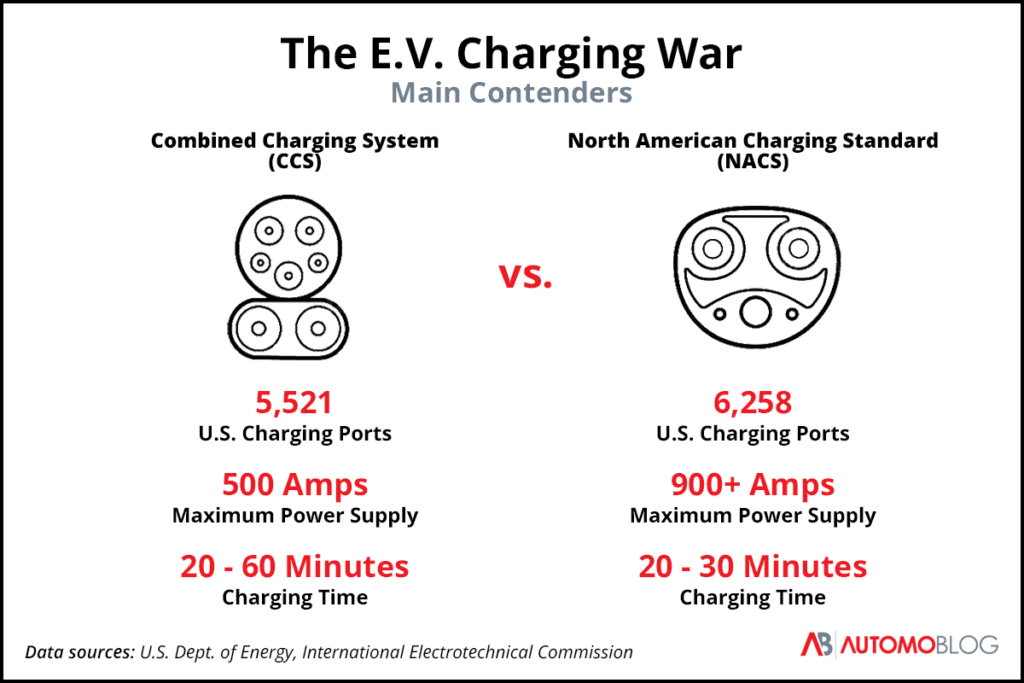

Critics have argued that the NACS chargers have several advantages over CCS chargers, including faster charging and more reliable performance. The NACS chargers have a smaller, more ergonomic design and are capable of more than 900 amps – compared to the 500 that CCS chargers are capable of.

Still, the announcement of the BIL looked like it could deal a fatal, or at least devastating, blow to the NACS system. However, when Tesla announced the name change, it also announced that it would share the technology with other automakers to encourage them to adopt it.

The NACS Port Just Picked Up Some Major Adopters

The decision to share the design for the NACS system may have saved it. Roughly seven months after the announcement, the NACS picked up some powerful supporters in Ford and General Motors.

In June, the American automotive giants announced that they would be integrating NACS technology into their EV lineups by 2025. The shift away from CCS and to NACS is a significant development. As of 2022, Ford and GM combined to make up 13% of the EV market share, according to data from Bank of America Global Research (BofAGR).

That same data estimates that the two automakers will account for a total of 28% of the market, holding 14% each, by 2026. Combined with the 18% market share that BofAGR estimates Tesla will own, an estimated 46% of new EVs will use NACS technology by 2026 – just from those three automakers alone.

Other companies such as Rivian and Volvo have also announced a shift towards NACS. Volkswagen, Stellantis, and Hyundai have all said that they were in talks with Tesla.

Ford and GM Using NACS Technology May Cause Issues for Tesla Owners

While Ford and GM jumping on board is a huge win for Tesla as a company, it may end up causing problems for Tesla owners, at least in the short term. Until recently, NACS chargers were exclusive to Tesla vehicles, meaning Tesla owners have had the entire network to themselves.

But once the deluge of new EVs from Ford, GM, and others equipped with NACS ports hit the road, the current infrastructure may not be enough to support it. In fact, many industry experts speculate that the EV charging infrastructure as a whole may not be able to support the increasing amounts of electric vehicles on the road in the near future.

Much of the manufacturing and development of EV charging stations has been built around CCS as the standard-to-be, and Tesla only recently released the NACS technology to the industry at-large. Because of such a relatively sudden shift, it may take time for NACS infrastructure to meet the influx in demand.

It May Be More Complex Than Just CCS vs. NACS

While some have taken to comparing the charging standard rivalry to the VHS versus Betamax format war of the 1980s, a more apt comparison might be Apple’s Lightning system versus the USB-C charging system used by Android phones. In the video format war, VHS emerged as the clear winner and Betamax effectively disappeared from the market. But there is a chance that CCS and NACS could coexist.

In 2022, Tesla announced that the company would be adding CCS chargers to its charging stations. This was even before subsidies for incorporating CCS technology as part of the BIL were announced. With billions of dollars in funding up for grabs, adding CCS plugs to Tesla charging stations alongside NACS chargers could make the company eligible to receive some of those funds.

Even if NACS ends up claiming most of the market share in the U.S., CCS is firmly established as the standard in the European Union. European car manufacturers especially may be reluctant to take on the added expense of producing two versions of the same car to accommodate both the E.U. and North American markets. Should they decide to hold out, there will still be substantial demand for CCS chargers.

Automakers and EV Owners May Get Caught in the Middle

The rise of the EV industry has allowed for the birth and growth of an EV charging infrastructure industry alongside it. According to a report from Research and Markets, the EV charging industry was valued at $3.15 billion in 2022. The report predicts that this market will grow to be worth $24.07 billion by 2030.

However, the EV charging standard war has the potential to disrupt this industry in the short term. Just a few months ago, companies could have comfortably formed plans to manufacture CCS-based charging stations for the U.S. market based on the industry’s trajectory at the time. But with such a substantial shift underway – and the potential for even more movement in the near future – manufacturers will need to adjust.

There is a great deal of public money at stake, too. In addition to the $7.5 billion the BIL makes available for charging station production, the U.S. Department of Transportation (DOT) National Electric Vehicle Infrastructure (NEVI) program provides funding to state and local governments to build out their EV charging infrastructure. That means manufacturers could effectively receive state and local funding through purchases on top of subsidies provided by the federal government. As of yet, however, companies could be uncertain of what kind of chargers to produce. With a financial windfall in the balance, some may hesitate to move forward on one or the other.

Current and potential owners of EVs could also be affected by this battle over charging standards if one of the two systems emerges as the clear winner. In this way, the VHS versus Betamax comparison may fit a little better. People who bought Betamax players were eventually left with practically useless technology as VHS gained a monopoly on the home video market. Similarly, if either CCS or NACS emerges as “the VHS of charging systems,” charging station manufacturers will eventually have no incentive to continue supporting the other system. As a result, owners of vehicles with those systems may be left with dwindling options to charge their EVs.

Right now, there is no clear indication of which format – if either – will become the dominant charging system in this country. While CCS is still the system of choice for many automakers, and carries the backing of the federal government and the funding it provides, NACS currently appears to have all the momentum and the reputation among many as being the superior technology.

It took more than 13 years for VHS to be declared the winner over Betamax. The EV charging standard war may not last until 2036, but it may be years before we see whether CCS or NACS comes out on top.