Affiliate Disclosure: Automoblog and its partners may earn a commission if you purchase a plan from the car insurance providers outlined here. These commissions come to us at no additional cost to you. Our research team has carefully vetted dozens of car insurance providers. See our Privacy Policy to learn more.

Progressive offers standard coverage options and unique add-on offerings, like loan/lease payoff, rental car reimbursement, and rideshare coverage.

- Progressive provides standard car insurance coverage types and several uncommon plans not commonly found with other providers.

- Loan/lease payoff, deductible savings bank, and custom parts and equipment value are some rare coverages offered by Progressive.

- Drivers often find high-quality auto insurance from State Farm and USAA as well as from Progressive.

In this article, we’ll explore all the Progressive car insurance coverage options available for drivers should they choose to purchase a policy with the provider. We’ll also mention some of the best auto insurance companies known for having strong coverage in the industry.

Progressive Car Insurance Plans

As one of the largest car insurance providers in the U.S., Progressive has an extremely wide range of coverage options for car owners. Whether you’re looking for a full coverage auto insurance policy or are just hoping to meet state minimum requirements, Progressive can likely cover your needs.

Progressive Car Insurance Coverage Types

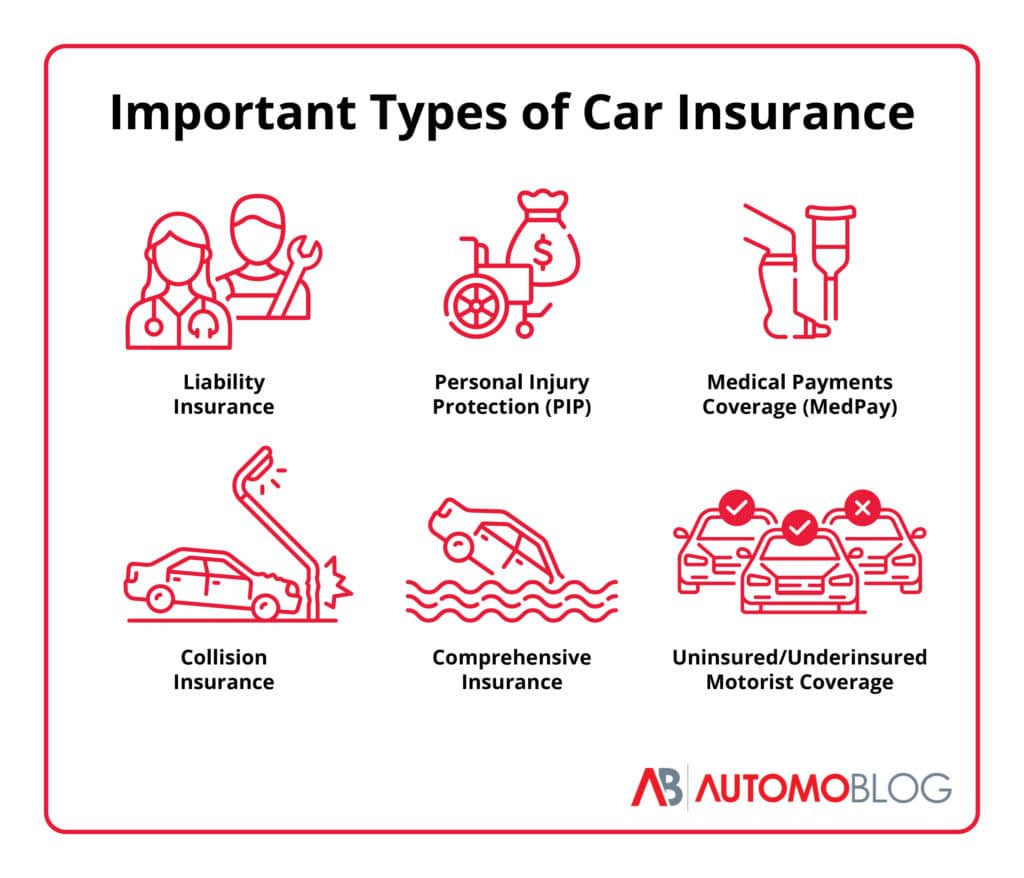

The standard Progressive car insurance coverage types include:

- Liability

- Collision

- Comprehensive

- Uninsured/underinsured motorist

- Medical payments (MedPay)/Personal injury protection (PIP)

We’ll cover each of these Progressive plan types in further detail below.

Progressive Liability Coverage

Liability coverage is required in almost every state and can be broken down into two key parts. Bodily injury liability insurance pays the medical bills of other drivers after an accident you caused, while property damage liability insurance covers damages to other people’s cars. Keep in mind that liability coverage will not pay for your own medical expenses or property damages.

While this insurance type is necessary for nearly every driver, the exact liability limits vary by state. In other words, you may need to carry a different amount of car insurance coverage depending on whether you live in New York, Texas, or Michigan.

Progressive Collision Coverage

Collision coverage deals with damages to your own vehicle after you hit another car or a stationary object such as a guardrail, tree or fence. This insurance type is completely optional but can greatly reduce your expenses if you get involved in a car accident.

Progressive Comprehensive Coverage

Comprehensive insurance covers car owners’ costs incurred for damages not caused by a collision. These potential issues can include weather events, windshield damages and glass breakage caused by falling tree branches.

Also worth noting is that comprehensive coverage covers instances of both vandalism and car theft. While comprehensive insurance is optional, it’s an extremely popular type of Progressive car insurance coverage.

Progressive Uninsured Motorist Coverage

Uninsured motorist coverage offers financial protection if you’re hit by another driver who lacks auto insurance. It also takes care of situations when you go through hit-and-run incidents. Similarly, underinsured motorist coverage helps to pay for your expenses when the other vehicle has car insurance, but not enough to cover all damages.

These two are often bundled together when you’re getting Progressive car insurance coverage. While several states make uninsured and underinsured motorist coverage mandatory, that isn’t true everywhere.

Progressive MedPay/Personal Injury Protection Coverage

Medical payments (MedPay) coverage helps to cover you and your passengers’ medical care after a covered accident. It takes care of injuries caused to those in the vehicle regardless of who was at fault for the road incident.

Many no-fault states offer personal injury protection (PIP) in place of MedPay. It offers similar coverage but also pays for lost wages and child care expenses. As with nearly all car insurance policies, you’ll likely still have to pay a deductible when filing a PIP claim.

Progressive Coverage Options

While the car insurance types listed above are found on many motorists’ policies, there are a few valuable add-ons that are less common. We’ll take a look at some of them below:

- Rental car reimbursement: Car insurance companies such as Progressive will pay for a rental car if your vehicle heads to the repair shop for a few days. This coverage type isn’t required, but may be helpful for Progressive customers with unreliable cars.

- Loan/lease payoff: Often known as guaranteed asset protection (GAP) insurance, this Progressive car insurance coverage type pays some of the difference between a vehicle’s actual value and the money still owed to your lender after a total loss incident.

- Roadside assistance: Those who select roadside assistance receive complimentary towing services, flat-tire changes, lockout assistance and fluid or fuel deliveries.

- Rideshare coverage: Rideshare coverage helps drivers who work for a rideshare company such as Uber or Lyft. You may not be covered by your employer while you’re waiting for jobs, and your personal auto insurance plan also won’t be in effect then.

- Custom parts and equipment value: Progressive insurance coverage choices sometimes move beyond the industry norm, and that’s true of this plan. Those who select custom parts and equipment value coverage receive up to $5,000 of replacements for damaged aftermarket accessories such as stereos and custom wheels.

- Deductible savings bank: Your collision and comprehensive deductible will be reduced by $50 for every six-month period you go without filing an auto claim. This optional coverage type could eventually eliminate car insurance deductibles for safe drivers.

Progressive car insurance coverage is relatively extensive, even compared to other companies’ auto insurance policies. Reach out to a nearby agent if you’re wondering whether Progressive’s choices could suit your needs.

What Does Progressive Accident Forgiveness Mean?

Progressive offers accident forgiveness for all policyholders who file claims of under $500. Those who haven’t filed a claim with Progressive in over five years will receive large accident forgiveness, which won’t increase your insurance rates even after damages of more than $500.

Progressive Insurance Products

In addition to auto insurance, Progressive offers a wide range of other types of coverage:

- Health insurance

- ATV/Motorcycle insurance

- Commercial auto insurance

- Life insurance

- Renters insurance

- Homeowners insurance

- Travel insurance

- Pet insurance

- Wedding and event insurance

- Insurance for driving in Mexico

- Phone and device insurance

- Mobile home insurance

- ID theft insurance

- Dental and vision insurance

- Classic car insurance

- Condo insurance

- Flood insurance

- Business insurance

Progressive Claims

Customers have two options when filing a Progressive auto insurance claim: get their vehicle repaired or receive a payment for the estimated cost of the repairs. Either way, customers can easily make a claim through Progressive’s mobile app, online, or by calling the number for the claims department.

Once the claim is made, an inspector will come to evaluate the damage and write up an estimate for the cost of repairs. You will receive payment directly or your claims representative will schedule repairs through a network repair facility. You will be responsible for your predetermined deductible.

Progressive Total Loss Claims

Claiming a total loss, however, is a different process. If repairs would cost more than the value of your vehicle, then an inspector will determine your vehicle is a total loss. This process requires more paperwork, but you will be paid for the value of your vehicle.

How Long Does a Progressive Claim Take?

Progressive says that claims usually take seven to 14 days to process. However, actual repairs to your vehicle may take much longer than that, depending on the damage and the repair shop.

How Much Car Insurance Coverage Do I Need?

Car insurance is mandatory in nearly every state, meaning that you’ll need to purchase protection to get behind the wheel. In general, minimum liability coverage will pay for some, if not all, injuries you are liable for in an accident.

The most commonly required liability limits are $25,000/$50,000/$25,000, which equates to:

- $25,000 bodily injury liability per person

- $50,000 bodily injury liability per accident

- $25,000 property damage liability per accident

State requirements vary greatly — so your state may mandate higher or lower limits than these, while also requiring additional coverages like PIP. In addition, if you are financing a vehicle, your lender may require you to carry coverage beyond your state’s minimum limits, such as a full coverage policy (which includes liability, comprehensive, and collision coverage).

And if you want better coverage to protect yourself and your vehicle, you’ll typically need to buy more than the minimum state requirements. We recommend shopping around for different coverage options to see what plans and coverage types fit your budget and needs.

Progressive Insurance Coverage: Is Progressive Insurance Good?

After thorough industry research, we found that Progressive can be a good option for drivers overall, whether they are looking for standard coverage or several add-on options. The provider has unique car insurance offerings that aren’t often seen in the industry, like deductible savings bank, loan/lease payoff, and rideshare coverage.

Progressive Alternatives With Strong Coverage Options

While Progressive has impressive offerings, we’d also recommend reaching out for instant quotes from State Farm and USAA. These companies are known for their impressive customer service and for the cheap auto insurance coverage they regularly provide.

State Farm: Best Overall

The offerings from State Farm are pretty comparable to Progressive car insurance coverage types and often come with competitive rates. Moreover, State Farm is known for its excellent customer service and for having local agents spread all across the U.S. Drivers commonly find car insurance discounts from State Farm, making it even easier to find affordable prices.

Keep reading: State Farm car insurance review

USAA: Best for Military Families

It’s hard not to recommend USAA for those in the military, their family members and veterans. That’s because the car insurer combines some of the industry’s highest marks for customer service with reasonable car insurance quotes. While military members often reach out to USAA, it’s unavailable for those who lack connections to the U.S. armed forces.

Keep reading: USAA car insurance review

Progressive Car Insurance Coverage: FAQ

Below are frequently asked questions about Progressive car insurance coverage.

What is included in full coverage with Progressive?

Full coverage car insurance from Progressive generally includes a combination of liability, comprehensive, and collision coverage. This type of coverage ensures that you and your vehicle are covered if you are in an accident or experience other life events like theft or vandalism.

How does Progressive determine if a car is totaled?

A vehicle is considered to have been totaled when the estimated repair costs are higher than the actual cash value (ACV) of the car. Each state sets its own rules for whether a vehicle is a total loss, and Progressive follows those guidelines when determining if your vehicle has been totaled

How do you cancel Progressive car insurance?

There is only one way to cancel Progressive car insurance and unfortunately, you can’t do it online. To cancel your Progressive coverage, take the following steps:

1. Call the Progressive customer service phone number at 1-866-416-2003.

2. Specify the effective date of the cancellation.

3. Provide the name of your new insurance provider, if you have one.

4. Ask if you are eligible for a pro-rated refund for any premiums you may have paid in advance.

Does Progressive pay well on claims?

According to the J.D. Power 2022 U.S. Auto Claims Satisfaction StudySM, Progressive underperformed when it came to claims satisfaction. The provider scored below several of its top competitors in the study.

Does Progressive cover high-risk drivers?

Progressive was one of the first car insurance companies to cover high-risk drivers. Today, the company is still one of the best when it comes to offering affordable coverage to drivers with recent at-fault accidents, moving violations, or DUIs.

Our Methodology

Our expert review team takes satisfaction in providing accurate and unbiased information. We identified the following rating categories based on consumer survey data and conducted extensive research to formulate rankings of the best car insurance providers.

- Affordability: A variety of factors influence cost, so it can be difficult to compare quotes between providers. Our team considers auto insurance rate estimates generated by Quadrant Information Services and discount opportunities when giving this score.

- Coverage: Because each consumer has unique needs, it’s essential that a car insurance company offers an array of coverage options. We take into account types of insurance available, maximum coverage limits, and add-on policies.

- Industry Standing: Our team considers Better Business Bureau (BBB) ratings, financial strength, and years in business when giving this score.

- Availability: Auto insurers with greater state availability and few eligibility requirements are more likely to meet consumer needs.

- Customer Service: Reputable car insurance providers operate with a certain degree of care for consumers. We consider complaints filed with the National Association of Insurance Commissioners (NAIC), J.D. Power claims servicing scores, and customer feedback.

- Online Experience: Insurers with easy-to-use websites and highly rated mobile apps scored best in this category.